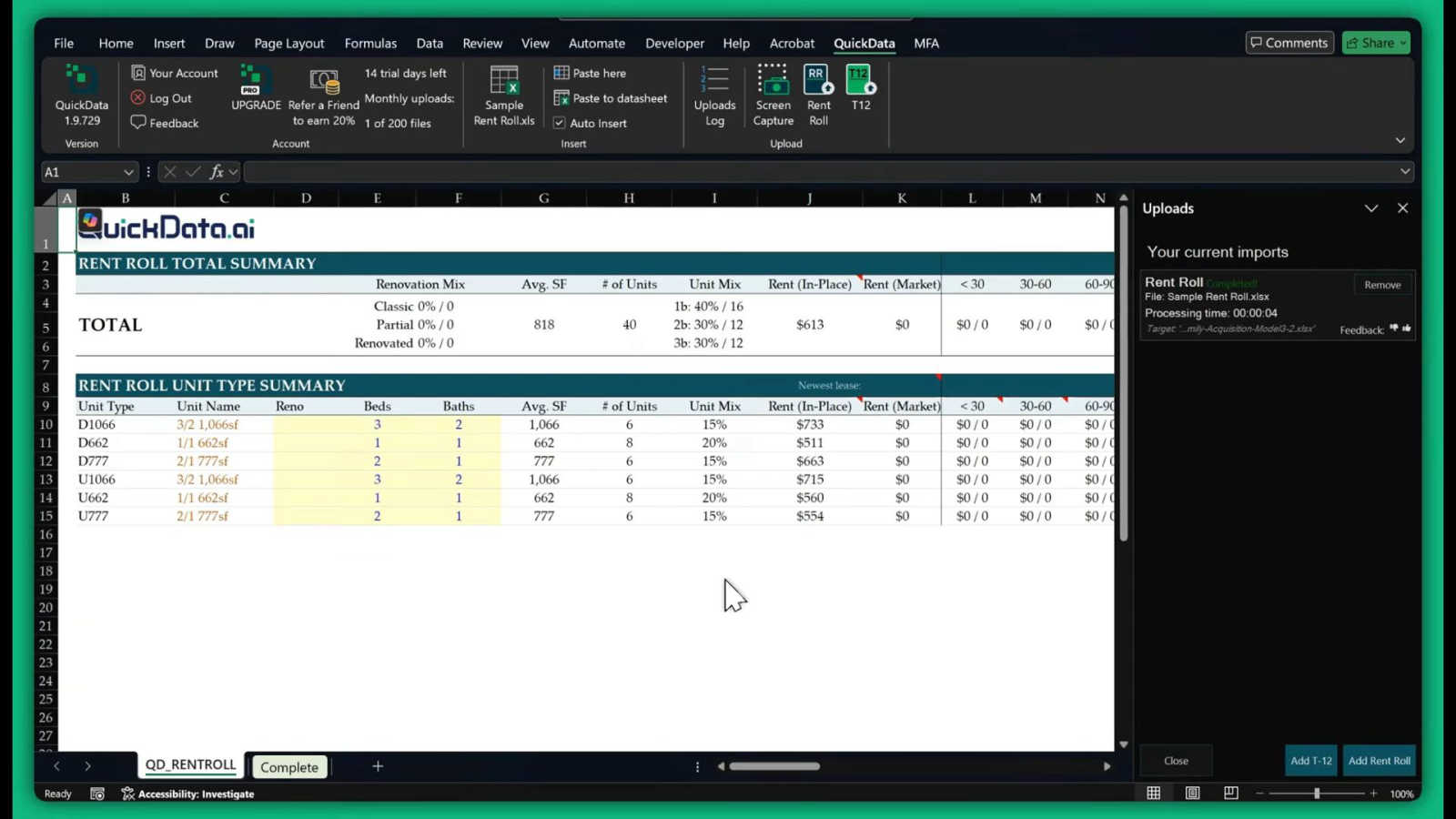

QuickData.ai

Automate multifamily underwriting by extracting rent roll and T12 data into Excel instantly.

Visit

About QuickData.ai

QuickData.ai is the intelligent Excel add-in engineered to supercharge multifamily real estate underwriting. It eliminates the most tedious bottleneck in the deal analysis process: manual data entry. By leveraging specialized AI, QuickData.ai automatically extracts critical financial data from complex documents like Rent Rolls, T12 (Trailing 12-Month) statements, and Offering Memorandums (OMs), and seamlessly populates it directly into your existing Excel underwriting models. This transformative tool is built for high-performance teams—acquisitions professionals, commercial brokers, lenders, and accounting firms—who need to analyze more deals with greater speed and accuracy. The core value proposition is powerful: reclaim an average of 15 hours per month, analyze potential acquisitions in minutes instead of days, and completely eliminate costly manual errors. QuickData.ai isn't just software; it's a strategic advantage that allows your team to scale operations, pursue more opportunities, and make data-driven investment decisions with unprecedented efficiency. It integrates directly into the tool you already use, requiring no complex setup, making advanced AI for commercial real estate instantly accessible.

Features of QuickData.ai

Automated Rent Roll Parsing

Our AI is specifically trained to understand the nuanced structure of multifamily rent rolls. It automatically identifies and extracts unit-level data such as unit numbers, floor plans, square footage, current rent, market rent, and lease expiration dates from any PDF or Excel file. This feature transforms a document that typically takes hours to manually input into a structured dataset ready for analysis in your Excel model in seconds, ensuring no detail is missed.

Intelligent T12 Statement Extraction

QuickData.ai meticulously parses through Trailing 12-Month financial statements, capturing all essential line items like gross potential rent, vacancy loss, other income, and every operating expense category. The AI contextualizes the data, correctly mapping each figure to the appropriate field in your underwriting model. This eliminates the risk of transposition errors and guarantees that your financial projections are built on a perfectly accurate historical baseline.

Seamless Excel Integration

The tool operates natively inside Microsoft Excel as a dedicated add-in. There's no need to export data to another platform or learn new software. Extracted data flows directly into your customized, firm-specific underwriting templates. This one-click integration preserves your existing workflows and model logic while supercharging the data ingestion phase, making adoption seamless for any analyst.

One-Click Bulk Processing

Scale your underwriting capacity effortlessly. QuickData.ai allows you to process multiple documents—such as a full rent roll and its corresponding T12—simultaneously with a single command. This bulk processing capability is designed for peak deal flow periods, enabling your team to evaluate entire portfolios or multiple competing offers in a fraction of the traditional time, dramatically increasing your competitive throughput.

Use Cases of QuickData.ai

Accelerated Multifamily Acquisitions Underwriting

Acquisitions teams can underwrite potential deals 10x faster. By automating the extraction of rent roll and T12 data into their DCF or valuation models, analysts shift their focus from manual data entry to high-value analysis like sensitivity testing, scenario planning, and investment committee preparation. This speed allows firms to evaluate more deals and move decisively on the best opportunities.

Enhanced Brokerage Deal Preparation

Commercial real estate brokers use QuickData.ai to rapidly prepare compelling offering packages and respond to buyer due diligence. They can quickly clean and standardize property data from various sources, creating accurate and professional pro formas and rent roll summaries in minutes. This efficiency improves client service and enables brokers to handle a greater volume of listings effectively.

Streamlined Lender Due Diligence

Lenders and debt underwriters leverage the tool to automate the initial financial analysis of a loan submission. Quickly extracting and verifying income and expense data from provided OMs and T12s speeds up the preliminary underwriting process, reduces processing bottlenecks, and minimizes the risk of human error in critical debt sizing calculations.

Efficient Portfolio Analysis for Accounting Firms

Accounting and advisory firms managing multiple client portfolios use QuickData.ai to automate the aggregation of operational data from various properties. This enables efficient periodic performance reviews, benchmarking, and audit preparation by turning scattered PDF reports into a consolidated, analyzable database in Excel without manual compilation.

Frequently Asked Questions

What document formats does QuickData.ai support?

QuickData.ai is designed to process the most common file types used in commercial real estate. It fully supports data extraction from PDF documents and Excel files. Whether you receive a scanned rent roll PDF or a digitally created T12 in Excel, our AI can parse the information and structure it for your model.

Does QuickData.ai work with my existing Excel underwriting model?

Absolutely. A core design principle of QuickData.ai is seamless integration. The add-in works within Excel and is built to populate data directly into your firm's proprietary underwriting templates. You do not need to adopt a new model; you simply enhance your current one with automated data ingestion.

Is there a trial available to test the software?

Yes, we offer a full-featured 14-day free trial so you can experience the time savings and accuracy firsthand. The trial includes free 1:1 onboarding to ensure you get set up quickly and can immediately start processing your own deal documents to see the real-world impact.

How does the AI handle differently formatted rent rolls or T12s?

Our AI is specifically trained on thousands of multifamily real estate documents, giving it a deep understanding of the commonalities and variations in how this data is presented. It uses contextual learning to identify key data points regardless of slight formatting differences, ensuring robust and reliable extraction across documents from different management companies or brokers.

You may also like:

Nani

Nani simplifies AI image generation by organizing prompts and images into reusable sets for a seamless creative workf...

DiffScout

DiffScout uses AI to monitor competitor prices 24/7 and alerts you instantly to catch changes before your customers do.

Beeslee AI Receptionist

Beeslee is your AI receptionist that answers calls and books appointments 24/7 so you never miss a lead.