finbots.ai

About finbots.ai

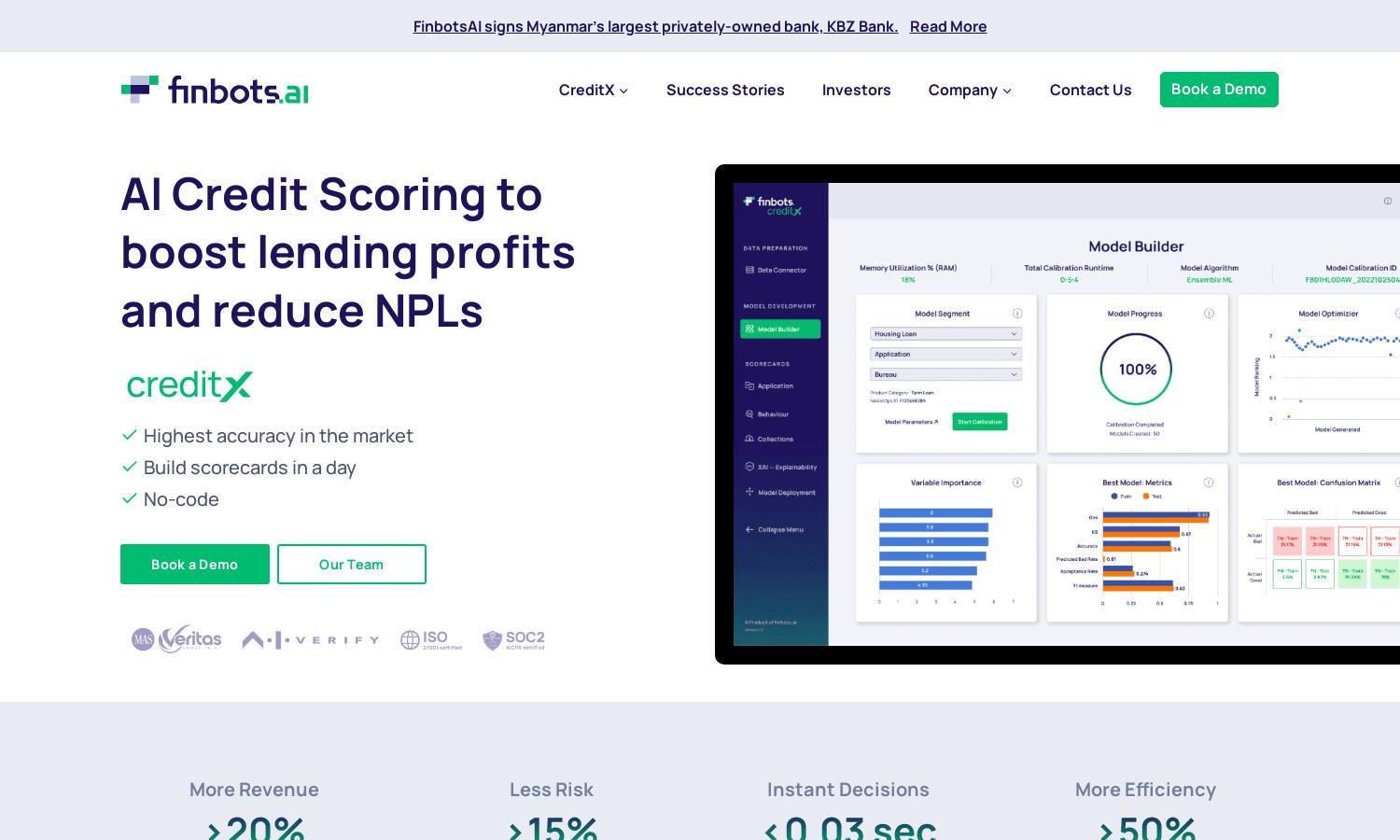

Finbots.ai is an advanced AI credit risk platform designed for lenders seeking efficiency and accuracy. Its standout feature, CreditX, enables the rapid development and deployment of custom scorecards, providing lenders with instant decisioning and improved profitability while reducing risks associated with lending decisions.

Finbots.ai offers flexible pricing plans tailored for banks and start-up lenders. With competitive rates for the first six months and a focus on maximizing value, users can access high-quality AI solutions affordably. Upgrading provides enhanced capabilities, ensuring compliance and a quicker turnaround for lending processes.

Finbots.ai features a clean, user-friendly interface designed for seamless interaction. Its intuitive layout enhances the browsing experience, making it easy for users to navigate through the platform's features. Special functionalities support efficient credit scoring and data management, ensuring users can utilize CreditX with ease.

How finbots.ai works

Users begin their journey with finbots.ai by signing up for CreditX, where they can easily connect their internal, external, and alternate data sources. The platform assists in building customized credit scorecards using advanced AI algorithms, allowing for real-time decision-making and automated validation, greatly enhancing the lending process.

Key Features for finbots.ai

Custom Scorecards

Finbots.ai’s custom scorecards feature allows users to quickly build tailored scoring models. This unique functionality empowers financial institutions to make accurate lending decisions with minimal time investment. CreditX automates complex data validation, enhancing operational efficiency and enabling lenders to respond swiftly to market needs.

Rapid Deployment

The rapid deployment capability of finbots.ai enables lenders to implement custom scorecards in just a day. This feature significantly reduces the traditional 9-12 month timeline, allowing businesses to adapt quickly and efficiently to the market. CreditX streamlines the process, enhancing overall competitiveness and profitability.

AI-Enabled Decision Making

Finbots.ai leverages AI-enabled decision-making to facilitate instant credit assessments. This unique feature minimizes approval times to less than 0.03 seconds, drastically improving operational effectiveness. By integrating predictive analytics, CreditX helps lenders reduce non-performing loans and enhance financial forecasting efforts, ensuring better risk management.

You may also like: