Chart

About Chart

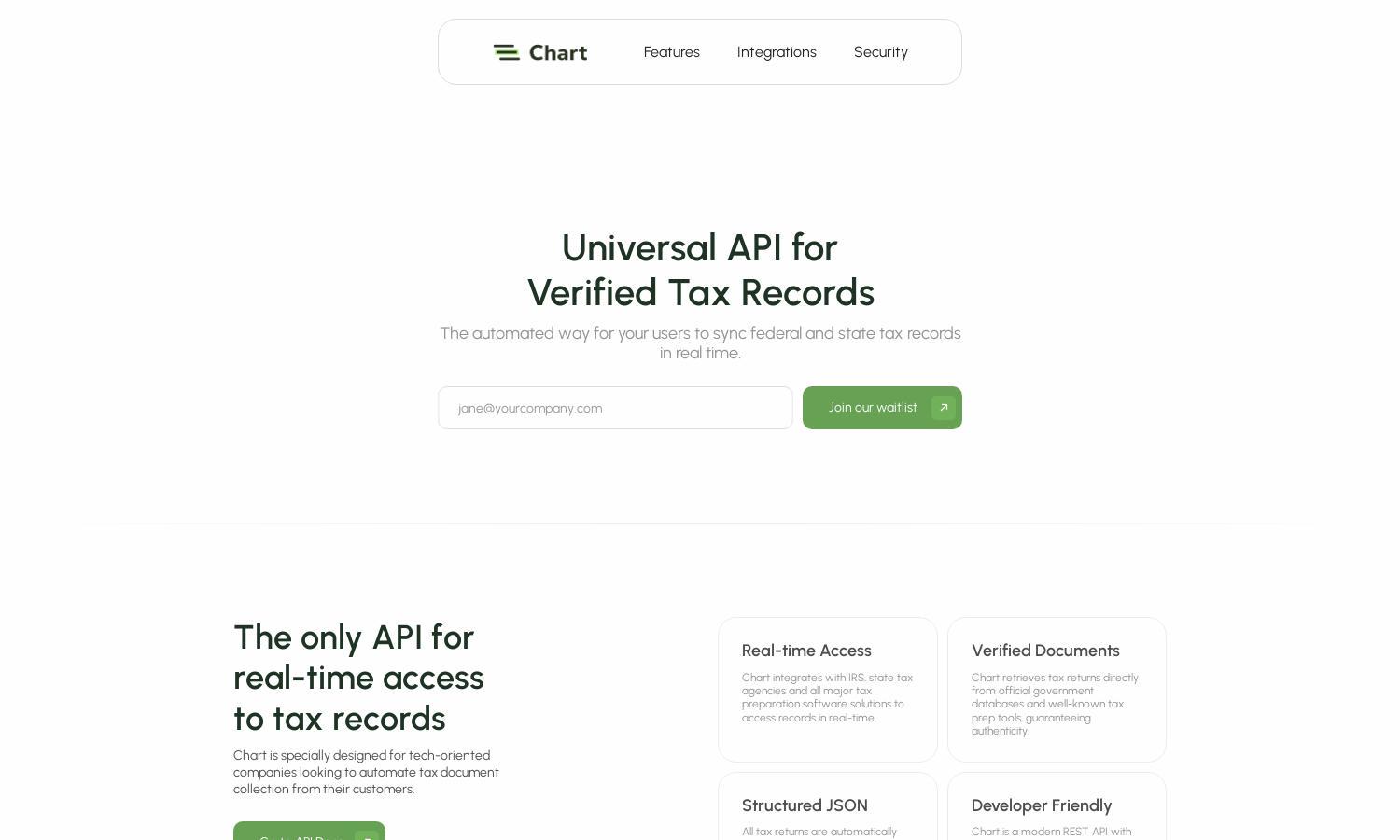

Chart is an innovative platform designed for tech-oriented companies seeking to automate tax document collection from customers. By integrating with IRS and major tax prep software, it ensures real-time access to verified tax records, enhancing compliance and user trust.

Chart offers flexible pricing plans tailored for businesses of all sizes. Users can start with a free tier for basic access and gradually upgrade to premium plans that unlock advanced features, real-time integrations, and custom support, ensuring a scalable solution for tax document automation.

Chart’s user interface is designed for smooth navigation with a modern layout that enhances the user experience. Featuring intuitive dashboards and accessible resources, users can efficiently manage tax records, making complex tax processes easier with straightforward tools and guidance.

How Chart works

Users begin by signing up at Chart and completing a straightforward onboarding process. They can easily connect their IRS and state online tax accounts or upload their tax preparation documents. With real-time data integration, users can access verified records and documents seamlessly, making tax collection effortless.

Key Features for Chart

Real-time Access

Chart’s real-time access feature allows users to sync federal and state tax records automatically. By integrating with IRS and tax preparation software, Chart provides instant, verified document retrieval, ensuring accuracy and reliability—an essential tool for efficient tax document management.

Verified Documents

Chart’s verified documents feature guarantees authenticity by retrieving tax returns directly from official government databases. This ensures that users receive accurate and trustworthy documentation, making it easier for businesses to manage tax records with confidence and meet compliance requirements.

Granular Access

The granular access feature at Chart empowers users with a consent flow to choose specific documents to share. This added control enhances user privacy and ensures that sensitive information is handled responsibly, making tax document management both secure and user-friendly.

You may also like: